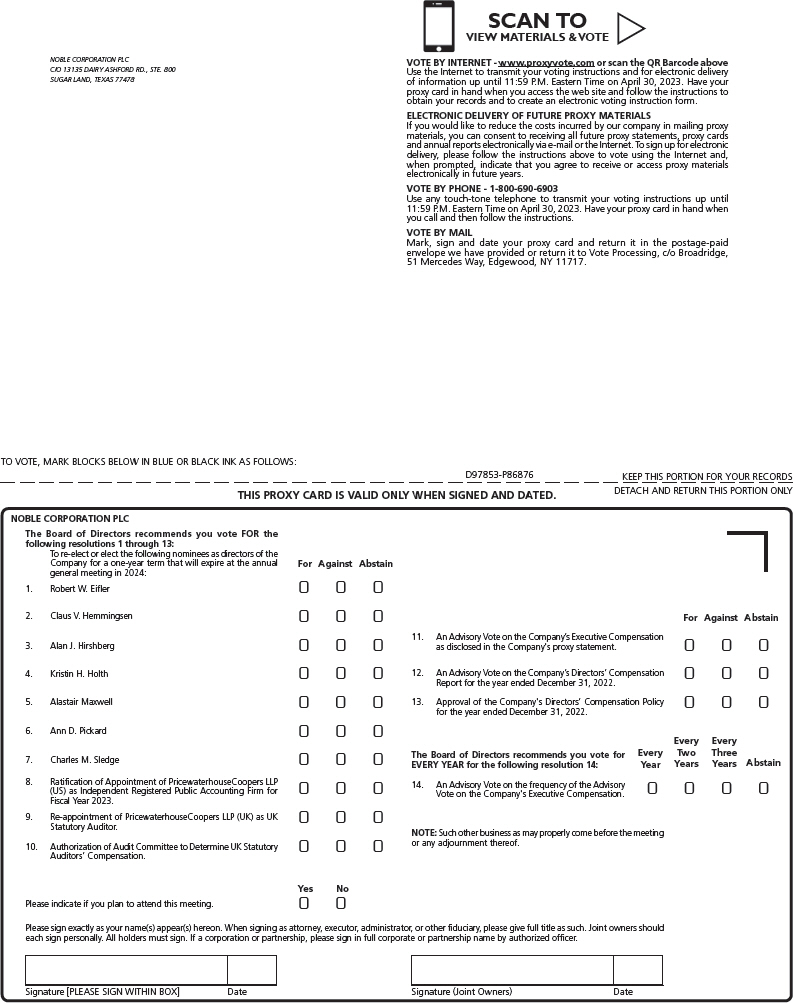

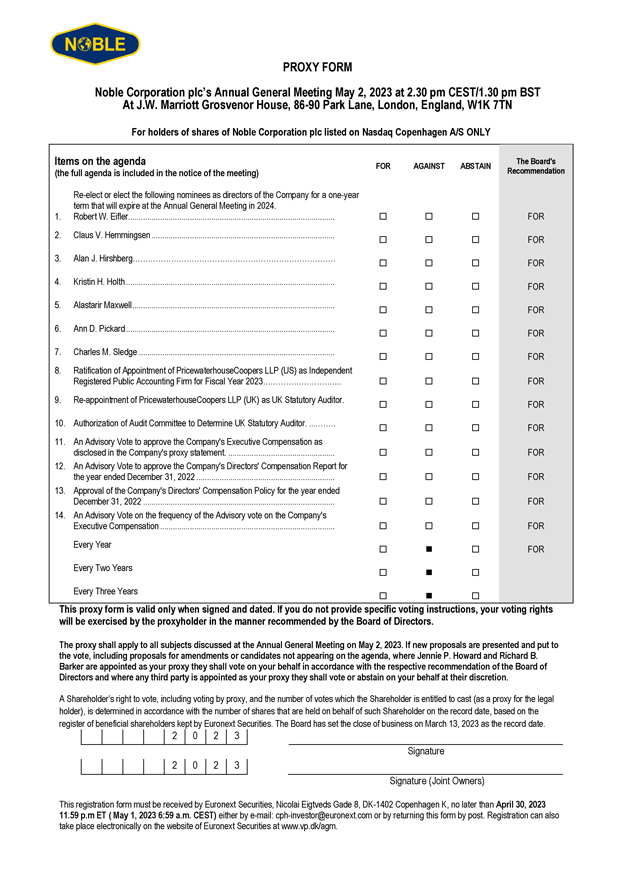

| | Resolutions 1-7

Director Nominees (SERVING A ONE-YEAR TERM EXPIRING AT THE ANNUAL GENERAL MEETING IN 2024)2025) | | | | | | | | Robert W. Eifler | | Age 43 | | Director since 2020 |

Robert W. Eifler Age 44 Director since 2020 Mr. Eifler was named President and Chief Executive Officer of the Company in May 2020. Previously, Mr. Eifler served as Senior Vice President, Commercial of the Company from August 2019 until assuming his current role. He served as Senior Vice President, Marketing and Contracts of the Company from February to August 2019, and as Vice President and General Manager – Marketing and Contracts of the Company from July 2017 to February 2019. Before that, Mr. Eifler led the Company’s marketing and contracts efforts for the Eastern Hemisphere while based in London. From November 2013 to March 2015, he worked for Hercules Offshore, Inc., an offshore driller, as Director, International Marketing. Mr. Eifler originally joined the Company in February 2005 as part of the management development program and held numerous operational and marketing roles with increasing responsibility around the world until joining Hercules Offshore, Inc. in 2013. Mr. Eifler received a B.S. in Systems and Information Engineering from the University of Virginia and an Acton MBA in Entrepreneurship. EXPERIENCE: The specific experience, qualifications, attributes, and skills that led our boardBoard to conclude that Mr. Eifler should serve as a director include his expertise in the areas of corporate governance, international business, operations, sales and marketing and engineering. He also has extensive experience in the oilfield services business. Further, it is the belief of our board that our CEO should be a member of the board of directors, and Mr. Eifler brings to our Board extensive knowledge of the Company and the industry as the President and Chief Executive Officer of the Company. Claus V. Hemmingsen | | | | | | | | Claus V. Hemmingsen | | Age 60 | | Director since 2022 |

Age 61 Director since 2022 Mr. Hemmingsen served as Chairman for Maersk Drilling from September 2016 to November 2022, and before that was the CEO of Maersk Drilling from 2005 to 2016. Mr. Hemmingsen originally joined A.P. Moller – Maersk in 1981 as a shipping trainee. After completing his shipping education, he moved to Maersk Drilling, before serving in Maersk Line from 1989, including 12 years in both Hong Kong and Singapore. In 2003 he returned to the head office in Copenhagen as Senior Vice President in Maersk’s global container activities, while also being responsible for APM Terminals until 2004. In 2016, he took up a number of other senior roles, including that of Vice CEO of A.P. Moller – Maersk. He left A.P. Moller - Maersk A/S in 2019. Mr. Hemmingsen is currently on the boards of and serves as chairman of the board for each of DFDS A/S (public), HusCompagniet A/S (public), and Innargi A/S. Mr. Hemmingsen also serves on the Board of A.P. Moller Holding A/S. He formerly served on the board of Maersk Drilling A/S (public). Mr. Hemmingsen has studied management at London Business School and Cornell University, and gained an Executive MBA from IMD in 2007. EXPERIENCE: The specific experience, qualifications, attributes, and skills that led our boardBoard to conclude that Mr. Hemmingsen should serve as a director include his expertise in the areas of administration and human resources, corporate governance, environmental and social responsibility, innovation, international business, operations and strategic planning. He also has extensive experience in the oilfield services business. Further, Mr. Hemmingsen’s prior service with Maersk Drilling provides business continuity that is of value to the board as the companyCompany integrates the Business Combination. Alan J. Hirshberg | | | | | | | | Alan J. Hirshberg | | Age 61 | | Director since 2021 |

Age 62 Director since 2021 Mr. Hirshberg currently owns VOR Advisors, Inc., which serves as a consultant to Elliot Management Corporation.consulting firm. Prior to that he served as a Senior Advisor at Blackstone Management Partners, which provides asset management services, from January 2019 to January 2022. He joined ConocoPhillips, an oil and gas company, in 2010 as its Senior Vice President, Planning and Strategy, and retired in January 2019 as its Executive Vice President, Production, Drilling and Projects, a position he held since April 2016. In this role, he had responsibility for ConocoPhillips’ worldwide operations, as well as supply chain, aviation, marine, major projects, drilling and engineering functions. Prior to joining ConocoPhillips, Mr. Hirshberg worked at Exxon and ExxonMobil for 27 years, serving in various senior leadership positions in upstream research, production operations, major projects and strategic planning. His last role at ExxonMobil was Vice President of Worldwide Deepwater and Africa Projects. Mr. Hirshberg is currentlywas formerly on the board of McDermott International, Inc., previously listed on the NYSE. (private). Mr. Hirshberg was formerly on the board of Sitio Royalties (f/k/a Falcon Minerals Corporation (public)). He received Bachelor and Master of Science degrees in Mechanical Engineering from Rice University. EXPERIENCE: The specific experience, qualifications, attributes, and skills that led our boardBoard to conclude that Mr. Hirshberg should serve as a director include his expertise in the areas of engineering, innovation, international business, operations, risk management, strategic planning, and cybersecurity. He also has broad experience in several areas of the energy industry and deep experience as a public company board member. | | | 10 | | 2024 Proxy Statement Noble Corporation plc2023 Proxy Statement | | 9

|

| | | | | | | | Kristin H. Holth Resolutions 1-8 | | | Age 67 | Director since 2022 |

Kristin H. Holth Age 68 Director since 2022 Ms. Holth served as Executive Vice President and Global Head of Ocean Industries in DNB Bank ASA – Norway’s largest financial services group, from 2017 to 2020. She has significant experience in capital markets and funding and has held numerous management positions within DNB over the years, including also Global Head of Shipping, Offshore & Logistics for four years and General Manager & Head of DNB Americas for six years. Ms. Holth is currently on the boards of GasLog Partners LP (public) and HitecVision A/S (public), Safe Bulkers (public), ABP AS (private), Maersk Tankers (private) and Maersk Supply Service (private). Previously, Ms. Holth served on Maersk Drilling’s board of directors.directors and on the board of GasLog (public). Ms. Holth holds a Bachelor in Economics and Business Administration from BI Norwegian Business School. EXPERIENCE: The specific experience, qualifications, attributes, and skills that led our boardBoard to conclude that Ms. Holth should serve as a director include her expertise in the areas of finance and treasury, international business, and risk management. She also has extensive experience in the oilfield services business and deep experience as a public company board member. Further, Ms. Holth’s prior service with Maersk Drilling provides business continuity that is of value to the board as the companyCompany integrates the Business Combination. H Keith Jennings Age 54 Director since 2023 Mr. Jennings served as Executive Vice President and Chief Financial Officer of Weatherford International, an oilfield service company, from September 2020 to August 2022, Executive Vice President and Chief Financial Officer of Calumet Specialty Products Partners, a manufacturer of a diversified slate of specialty branded products in various consumer and industrial markets, from October 2019 to August 2020, Vice President, Finance of Eastman Chemical Company from 2018 to 2019, Vice President & Treasurer of Eastman Chemical Company from 2016 to 2018 and Vice President & Treasurer of Cameron International from 2009 to 2016. He currently serves on the board of 5E Advanced Materials, Inc. (public). Mr. Jennings holds a Bachelor of Commerce from the University of Toronto and a Master of Business Administration from Columbia University and is a Chartered Professional Accountant. | | | | | | | | Alastair Maxwell | | Age 59 | | Director since 2022 |

EXPERIENCE: The specific experience, qualifications, attributes, and skills that led our board to conclude that Mr. Jennings should serve as a director include his expertise in the areas of accounting, finance and treasury. He also has broad experience in the energy and chemical industries, experience as a public company board member, and has served as a chief financial officer. Alastair Maxwell Age 60 Director since 2022 Mr. Maxwell is currently CFO of C2X, a renewable methanol company. Mr. Maxwell has served as CFO of Signifier Medical Technologies Ltd., a medical technology company, since November 2020, and has previously held the position as CFO of GasLog Ltd, an owner, operator, and manager of liquefied natural gas carriers, from 2017 to 2020.until July 2023. Prior to that he worked in the investment banking industry for 29 years, most recently with Goldman Sachs from 2010 to 2016, where he was a partner and Co-Head of the Global Energy Group with responsibility for relationships with a wide range of corporate and other clients. Previously, he was with Morgan Stanley, most recently as Managing Director and Head of Energy in the EMEA region, and with Dresdner Kleinwort Benson in a series of roles in the Utilities and M&A Groups. Previously, Mr. Maxwell served on Maersk Drilling’s board of directors from 2019 to 2022. Mr. Maxwell studied Modern Languages (Spanish and Portuguese) at Worcester College, Oxford. The specific experience, qualifications, attributes, and skills that led our boardBoard to conclude that Mr. Maxwell should serve as a director include his expertise in the areas of accounting, finance and treasury, international business, and risk management. He has also served as a chief financial officer. Further, Mr. Maxwell’s prior service with Maersk Drilling provides business continuity that is of value to the board as the companyCompany integrates the Business Combination. Ann D. Pickard | | | | | | | | Ann D. Pickard | | Age 67 | | Director since 2021 |

Age 68 Director since 2021 Ms. Pickard retired from Royal Dutch Shell, an oil and gas company, in 2016, having held numerous positions of increasing responsibility during her 15-year tenure with Shell. She last served as Executive Vice President, Arctic and was responsible for Shell’s Arctic exploration efforts. This followed three successful years as Executive Vice President of Shell’s Exploration and Production business and Country Chair of Shell in Australia where she oversaw Gas Commercialization, Manufacturing, Chemicals, Supply and Distribution, Retail, Lubricants, Trading and Shipping, and Alternative Energy. Ms. Pickard was previously Shell’s Regional Executive Vice President for Sub Saharan Africa. Based in Lagos, Nigeria, she was accountable for | | | | Noble Corporation plc 2024 Proxy Statement | | 11 |

Shell’s Exploration & Production, Natural Gas, and Liquefied Natural Gas (LNG) activities in the region. Before that, Ms. Pickard was Director, Global Businesses and Strategy and a member of the Shell Gas & Power Executive Committee with responsibility for Global LNG, Power, and Gas & Power Strategy. Ms. Pickard joined Shell in 2000 after an 11-year tenure with Mobil prior to its merger with Exxon. Ms. Pickard is a director of KBR, Inc. and Woodside Energy Group Ltd. (each public). Ms. Pickard holds a Bachelor of Arts degree from the University of California, San Diego and a Master of Arts degree from the University of Pennsylvania. The specific experience, qualifications, attributes, and skills that led our boardBoard to conclude that Ms. Pickard should serve as a director include her expertise in the areas of administration and human resources, environmental and social responsibility, finance and treasury, international business, legal, operations, and engineering. She also has broad experience in all areas of the energy industry, deep experience as a public company board member, and has served as a chief executive officer. Charles M. Sledge | | | | | | | | Charles M. Sledge | | Age 57 | | Director since 2021 |

Age 58 Director since 2021 Mr. Sledge previously served as the Chief Financial Officer of Cameron International Corporation, an oilfield services company, from 2008 until its sale to Schlumberger Limited in 2016. Prior to that, he served as the Corporate Controller of Cameron International Corporation from 2001 until 2008. He currently serves on the boards of Weatherford International plc, where he serves as chairman, and Talos Energy, Inc. (each public). He previously served on the boards of Stone Energy Corp., and Vine Energy, Inc. (each public). Mr. Sledge received a BS in Accounting from Louisiana State University and is a graduate of the Advanced Management Program at Harvard University. EXPERIENCE: The specific experience, qualifications, attributes, and skills that led our boardBoard to conclude that Mr. Sledge should serve as a director include his expertise in the areas of accounting, finance and treasury, and operations. He also has broad | | | 10

| | 2023 Proxy StatementNoble Corporation plc

|

experience in the energy exploration industry, deep experience as a public company board member, and has served as a chief financial officer. Involvement in certain legal proceedings. The Company filed for bankruptcy protection in 2020, see “Explanatory Note” at page V. Certain of our directors and executive officers served in such capacity with the Company at the time of the bankruptcy filing. Mr. Eifler served as a director and executive officer, and Mr. Barker Ms. Campbell, and Mr. Turcotte served as an executive officersofficer at the time the petition was filed. Director Designation Right In connection with the closing of the Business Combination, the Company entered into a Relationship Agreement (the “Relationship Agreement”) with APMH Invest A/S (“APMH Invest”), which set forth certain director designation rights of APMH Invest following the Closing Date for the Business Combination. Under the terms of the Relationship Agreement, APMH Invest is entitled to designate (a) two nominees to our Board so long as APMH Invest owns no fewer than 20% of the then outstanding Company shares and (b) one nominee to our board so long as the APMH Invest owns fewer than 20% but no fewer than 15% of the then outstanding Company shares. The Relationship Agreement will terminate once APMH Invest owns fewer than 15% of our outstanding shares. APMH Invest has designated Mr. Hemmingsen as its sole designee under the Relationship Agreement. Except as described above, there is no other arrangement or understanding between or among othermembers of the Board and any other persons pursuant to which he or she was appointed as a member of the Board. None of the members of the Board have any family relationship with any director or executive officer of Noble. There is no relationship between any member of the Board and Noble that would require disclosure pursuant to Item 404(a) of Regulation S-K. Executive Officers Mr. Eifler, our Chief Executive Officer, serves on our Board. For his biography, please refer to “—Director Nominees” on page 9.10. Caroline M. Alting Age 48 Ms. Alting was named Senior Vice President of Operational Excellence & Sustainability of Noble in January 2024. Previously, Ms. Alting served as Senior Vice President of Operational Excellence since October 2022. Before joining Noble, Ms. Alting served as Senior Vice President and Head of Integrity and Projects of Maersk Drilling since June 2020. Previously, she served | | | | 12 | | 2024 Proxy Statement Noble Corporation plc |

as Vice President and Head of Engineering and Projects of Maersk Drilling from June 2018. Prior to that, she served in several roles with Maersk Drilling from May 2009, including Deputy Asset Manager, Project Team Lead, and Senior Project Engineer. Before joining Maersk Drilling, Ms. Alting served with Maersk Oil from November 2003 to May 2009. She has served on the Board of Maersk Drilling as an employee elected member since March 2019 and is a member of the Advisory Boards of MCEDD and the IASC/SPE International Drilling Conference. Ms. Alting holds an MSc in Chemistry from the Technical University of Denmark and a PMD from IESE Business SchoolSchool. Richard B. Barker Age 43 Mr. Barker was named SeniorExecutive Vice President and Chief Financial Officer of Noble in January 2024 and was previously Senior Vice President and Chief Financial Officer since March 2020. He joined Noble following investment banking positions at firms including Moelis & Company which he held from 2019 to 2020 and JPMorgan Chase & Co.Co prior to 2019 where he specialized in oilfield services and equipment. Mr. Barker graduated magna cum laude from Rice University, where he earned a B.A. in Mathematical Economic Analysis and Managerial Studies. | | | | | | | | Laura D. CampbellBlake A. Denton | | Age 51 | | |

Ms. Campbell was named Vice President and Controller of Noble in August, 2018. She is a certified public accountant with more than 20 years of experience. Before joining Noble, Ms. Campbell served as Assistant Controller, Policy and Corporate Reporting at Chevron Phillips Chemical Company LLC, a petrochemical company from March 2017 until July 2018. Prior to that time, Ms. Campbell worked at Noble from 2007 to March 2017, serving in the positions of Assistant Controller and Director of Corporate Accounting.

Age 45 Mr. Denton was named Senior Vice President of Marketing and Contracts of Noble in October 2022. Previously, he served as Director of Marketing and Contracts for Noble from January 2017 until assuming his position as Vice President in March 2020, where he led Noble’s marketing and contracts efforts for the Middle East and India while based in Dubai. Prior to that, Mr. Denton served as our Project Director from March 2012 to January 2017 based in Korea and Houston, and as | | | Noble Corporation plc2023 Proxy Statement

| | 11

|

Project Manager from August 2010 to March 2012 based in Singapore. Before that, he led Noble’s newbuild project electrical engineering efforts for dynamically positioned drilling assets as a consultant based first in Houston and then in Singapore. Before joining Noble, Mr. Denton worked for a Houston-based electrical integration company supplying power generation and controls equipment primarily to the marine and drilling industry worldwide. Mr. Denton Bachelor of Science in Industrial Distribution from Texas A&M University’s College of Engineering. Mikkel Ipsen Age 51 Mr. Ipsen was named Senior Vice President of Human Resources of Noble in January 2024 and was previously Vice President of Human Resources since October 2022. Prior to joining Noble, he served as Vice President and Head of HR Partnering of Maersk Drilling since October 2021. Prior to joining Maersk Drilling, Mr. Ipsen served as Head of Talent Development – Northern Europe & Russia of TotalEnergies, an energy and petroleum company, since January 2020, and as Head of Human Resources – Denmark of TotalEnergies from March 2018 to January 2020. Previously, he held senior positions within human resources at Maersk Drilling, Maersk Oil and TotalEnergies, including working on the integration of Maersk Oil into TotalEnergies. Mr. Ipsen started his career as a line officer in the Danish Armed Forces where he served for 16 years. He holds a Master of Military Studies from the Royal Danish Defence College. Joey M. Kawaja Age 50 Mr. Kawaja was named Senior Vice President of Operations of Noble in October 2022. He has over 25 years of experience in offshore rig operations and project management. Previously, Mr. Kawaja served as Regional Manager – Western Hemisphere, where he led all of Noble’s shorebased and offshore operations in North and South America, from August 2014 until assuming his position as Vice President of Operations in October 2020. Prior to that, Mr. Kawaja served in various roles including Operations Manager, Drilling Superintendent, and Project Manager since joining Noble in 1996. Jennie P. Howard | | | | | | | | William E. Turcotte | | Age 59 | | |

Mr. TurcotteAge 38

Ms. Howard was named Senior Vice President and General Counsel of Noble in December, 2008. He was named Corporate Secretary in January 2018. He will cease serving as an executive officer on April 1, 2023 and will remain in our employ as a special advisor to the CEO through February 2024. Prior to joining Noble, Mr. Turcotte served as Senior Vice President, General Counsel and Corporate Secretary of Cornell Companies, Inc. from 2007 to 2008. Before joining Cornell, he was most recently Vice President, Associate General Counsel and Assistant Secretary of Transocean, Inc., where he worked from 2000 to 2007. Between 1992 and 2000, he served in various legal positions with Schlumberger Limited in Houston, Caracas and Paris, and prior to 1992, he worked as a legal associate in law firms in Mexico City and Houston. Ms. Howard will become Senior Vice President, General Counsel and Corporate Secretary of Noble on April, 1, 2023. Prior to joining Noble, Ms. Howard served as Vice President, Assistant General Counsel and Assistant Corporate Secretary of Kraton Corporation, a specialty chemicals company, with which she was employed from September 2015 to March 2022. Before joining Kraton Corporation, Ms. Howard was a corporate associate with Hunton Andrews Kurth LLP in its Houston, Texas Office. She holds a BA in History and Politics from Durham University in the United Kingdom, and a Juris Doctor degree from American University Law School.

| | | | Noble Corporation plc 2024 Proxy Statement | | 13 |

Jennifer Yeung Age 40 Ms. Yeung was named Vice President, Chief Accounting Officer and Controller of Noble in November 2023. Prior to joining Noble, she served at Ernst & Young LLP, an accounting and professional services firm, in various roles of increasing responsibility since January 2007. Most recently, Ms. Yeung served as Audit Managing Director from October 2020 through September 2023, and as Audit Senior Manager from July 2014 through October 2020, serving clients across a range of industries including offshore drilling. Ms. Yeung is a certified public accountant and received a Bachelor of Accountancy and a Bachelor of Business Administration, Finance from Loyola University. Corporate Governance Board Independence Our Board has determined that: each of Mr. Hemmingsen, Mr. Hirshberg, Ms. Holth, Mr. Jennings Mr. Maxwell, Ms. Pickard and Mr. Sledge qualifies as an “independent” director under the NYSE corporate governance rules; each of Mr. Jennings (Chair), Ms. Holth Mr. Maxwell (Chair), and Mr. Sledge, constituting all the members of the audit committee of the Board (the “Audit Committee”), qualifies as “independent” under Rule 10A-3 of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”); and each of Mr. Hirshberg (Chair), Mr. Maxwell, and Mr. Sledge, constituting all the members of the compensation committee,Compensation Committee, qualifies as | • | | “independent” under Rule 10C-1(b)(1) under the Exchange Act and the applicable rules of the NYSE; and

|

“independent” under Rule 10C-1(b)(1) under the Exchange Act and the applicable rules of the NYSE; and | • | | a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act.

|

a “non-employee director” for purposes of Rule 16b-3 under the Exchange Act. Independent non-management directors comprise in full the membership of each committee described below under “—Board Committees, Meetings and Other Governance Matters.” | | | 12

| | 2023 Proxy StatementNoble Corporation plc

|

Mr. Eifler, our current President and Chief Executive Officer, is not independent because of his service as a member of our senior management. Our Board had also determined that each of our directors who left the board upon the closing of the Business Combination was also independent, which included Mr. Aronzon, Mr. Bartels, and Ms. Trent.

In order for a director to be considered independent under the NYSE rules, our Board must affirmatively determine that the director has no material relationship with the Company other than in his or her capacity as a director of the Company. The Company’s corporate governance guidelines provide that a director will not be independent if, the director is, or during the preceding three years, was employed by the Company; an immediate family member of the director is, or during the preceding three years, was an executive officer of the Company; the director or an immediate family member of the director received, within any 12-month period during the preceding three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); the director is a current partner or employee of the Company’s internal or external auditor; an immediate family member of the director is a current partner of the Company’s internal or external auditor; an immediate family member of the director is currently employed by the Company’s internal or external auditor and personally works on the Company’s audit; the director or an immediate family member of the director was, during the preceding three years, a partner or employee of the Company’s internal or external auditor and personally worked on the Company’s audit within that time; the director or an immediate family member of the director is, or, during the preceding three years was, employed as an executive officer of another company where any of the Company’s present executive officers serves or served on that company’s compensation committeeCompensation Committee at the same time; or | | | | 14 | | 2024 Proxy Statement Noble Corporation plc |

the director currently is an executive officer or an employee, or an immediate family member of the director currently is an executive officer, of a company that made payments to, or received payments from, the Company for property or services in an amount which, in any single fiscal year within the last three fiscal years, exceeded the greater of $1 million or two percent of such other company’s consolidated gross revenues. The following will not be considered by our Board to be a material relationship that would impair a director’s independence: If a director is an executive officer of, or beneficially owns in excess of 10 percent equity interest in, another company that does business with the Company, and the amount of the annual payments to the Company is less than five percent of the annual consolidated gross revenues of the Company; that does business with the Company, and the amount of the annual payments by the Company to such other company is less than five percent of the annual consolidated gross revenues of the Company; or to which the Company was indebted at the end of its last fiscal year in an aggregate amount that is less than five percent of the consolidated assets of the Company. For relationships not covered by the guidelines in the immediately preceding paragraph, the determination of whether the relationship is material or not, and therefore whether the director would be independent or not, is made by our directors who satisfy the independence guidelines described above. These independence guidelines used by our Board are set forth in our corporate governance guidelines, which are published under the governance section of the Company’s website at www.noblecorp.com. In evaluating the independence of Mr. Hirshberg, the Board considered athe following: A consulting agreement entered into between VOR Advisors, Inc., an advisor firm owned by Mr. Hirshberg, and Elliott Investment Management L.P. (“Elliott”), previously a known non-affiliated shareholder of the Company, pursuant to which Mr. Hirshberg would advise Elliott in connection with certain investments outside the offshore drilling industry. The Board determined that this consulting agreement did not interfere with Mr. Hirshberg’s exercise of independent judgment in carrying out his responsibilities as a director. Mr. Hirshberg remains subject to all applicable Company policies. | | | Noble Corporation plc2023 Proxy Statement

| | 13

|

In addition, in order to be independent for the purposes of serving on our on audit committee,the Audit Committee, a director may not, other than in his or her capacity as a member of the audit committee,Audit Committee, the Board, or any other board committee: accept directly or indirectly, any consulting, advisory, or other compensatory fee from the Company or one of our subsidiaries (other than certain retirement benefits for prior service with the Company); or be affiliated with the Company, one of our subsidiaries, or an affiliate of one of our subsidiaries. Further, in order to determine the independence of any director who will serve on the compensationCompensation committee, the Board must consider all factors specifically relevant to determining whether a director has a relationship to the Company that is material to that director’s ability to be independent from management in connection with the duties of a compensationCompensation committee member, including, but not limited to: the source of compensation of such director, including any consulting, advisory or other compensatory fee paid by the Company to such director; and whether such director is affiliated with the Company, one of our subsidiaries or an affiliate of one of our subsidiaries. In accordance with the Company’s corporate governance guidelines, the non-management directors have chosen an independent Chair of the Board to preside at regularly scheduled executive sessions of our Board held without management present. Mr. Sledge currently serves as our independent Chair. | | | | Noble Corporation plc 2024 Proxy Statement | | 15 |

Director Skills Matrix The directors skills matrix assists the Board in considering the appropriate balance of experience, skills and attributes required of a director and to be represented on the Board as a whole. The skills matrix was developed after considering the Company’s near and long-term strategies and is intended to identify skills and attributes that will assist the Board in exercising its oversight function. The skills matrix assists in determining whether a potential Board member’s skills would complement the skills of the current Board members. The matrix is a summary;summary of key skills; it does not include all of the skills, experiences and qualifications that each director nominee offers, and the fact that a particular experience, skill or qualification is not listed does not mean that a director does not possess it. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Director | | Skill | | Mr. Eifler | | Mr. Hemmingsen | | Mr. Hirshberg | | Ms. Holth | | Mr. Maxwell | | Ms. Pickard | | Mr. Sledge | Accounting | | | Mr. Hemmingsen | | | Mr. Hirshberg | | | Ms. Holth | | | Mr. Jennings | | | Mr. Maxwell | | | Ms. Pickard | | | Mr. Sledge | | | | | | | | | | | Operations | | | X | | | | X | | | | X | | | | | | | | | | | | | | | | X | | | | X | | | Administration | | | | | | | | Drilling / HROFS | | | X | | | | X | | | | X | | | | | | | | X | | | | Corporate governance | | X | X | | | | | | | | X | | X | Cybersecurity | | | | | | X | | | | X | | | | | | | | | | | Finance / Treasury | | | | | | | | | | | | | | | X | Environmental / social responsibility | | | | X | | | | X | | | | X | | | Finance / treasury | | | | | | | | X | | | X | | | | | | | | Accounting | | | X | | | | X | Innovation | | | | | | | X | | X | | | | | | | | International business | | X | | X | | X | | X | | X | | X | | X | Operations | | X | | X | | X | | | | | | X | | X | Risk management | | X | | X | | X | | X | | X | | X | | X | Sales / marketing | | X | | | | | | | | | | X | | | | | | Strategic planning | | X | | | X | | | | | | | | Legal / Gov’t | | | X | | | | | | | | | | | | X | | | | X | | Technical / engineering | | | | | | X | | | | | | | | | | | | | | | Administration / HR | | | | | | | X | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | Technical / Engineer | | | X | | | | | | | | X | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | Sales / Marketing | | | X | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | International Business | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | | | | | | | | Strategic Planning | | | X | | | | X | | | | X | | | | X | | | | X | | | | | | | | X | | | | X | | | | | | | | | | | Innovation | | | | | | | X | | | | X | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Cyber Security | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | Environmental / Social | | | | | | | X | | | | X | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | | | | Corporate Governance | | | X | | | | X | | | | X | | | | X | | | | X | | | | | | | | X | | | | X | | | | | | | | | | | Risk Management | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | |

Board Committees, Meetings and Other Governance Matters The Company has standing audit, compensation, nominating and governance, and safety and sustainability committees of our Board. Each of these committees operates under a written charter that has been adopted by the respective committee and by our Board. The charters are published under the governance section of the Company’s website at www.noblecorp.com and are available in print to any shareholders who request them. Prior to Our Code of Business Ethics is published under the closinggovernance section of the Company’s website at www.noblecorp.com. We intend to disclose future amendments to certain provisions of the Code of Business Combination, our Board was comprisedEthics, and waivers of Paul Aronzon, Patrick J. Bartels, Jr., Robert W. Eifler, Alan J. Hirshberg, Ann D. Pickard, Charles M. Sledge,the Code of Business Ethics granted to executive officers and Melanie M. Trent.directors, on the website within four business days following the date of the amendment or waiver.

| | | 14

| | 2023 Proxy StatementNoble Corporation plc

|

Board Refreshment We recognize the importance of board refreshment, and the nominating and governanceNominating & Governance committee regularly considers board composition and how directors change over time. To assist our board refreshment efforts, our corporate governance guidelines provide for a mandatory retirement age of 72. Our Board’s current view is that given the recent changes to our Board as a result of the closing of the Business Combination and the short tenure of all of the members of the Board, our Board has been substantially refreshed and a period of relative stability in board composition is in the best interests of our Company and our shareholders as we navigate the integration of the Business Combination.72, without exception. Further, under the Relationship Agreement entered in connection with the Business Combination, one of our non-management directors has been designated by a former shareholder of Maersk Drilling. See –”–“Director Designation Rights,” above at page 11,12, for further information on this agreement. Nevertheless,At the conclusion of the Business Combination in the fall of 2022 our Board reflected the diverse background and perspectives from each of the legacy Noble and Maersk Drilling boardrooms. In November of 2023, in our first director appointment to the Board since the Business Combination, we appointed a person who identifies as racially diverse. The Board and the nominating and governanceNominating & Governance committee continuously discusses and considers board refreshment and composition as the members believe that the Board should be comprised of directors with diverse yet complementary backgrounds who bring different perspectives and experiences to the boardroom, generating healthy discussion and debate and more effective decision-making. | | | | 16 | | 2024 Proxy Statement Noble Corporation plc |

Board Committee Membership The current members of the committees, number of meetings held by each committee during 20222023 and a description of the functions performed by each committee are set forth below. | | Director Name | | Audit | | Compensation | | Nominating and

Governance (3) | | Safety and

Sustainability (3) | | Audit | | Compensation | | Nominating &

Governance | | Safety &

Sustainability | | | Robert W. Eifler | | | | | | | | | Robert W. Eifler | | | | Claus V. Hemmingsen | | | | | | ✓ | | Chair | Claus V. Hemmingsen | | | | | ✓ | | Chair | | | Alan J. Hirshberg | | | | Chair | | ✓ | | | Alan J. Hirshberg | | | | Kristin H. Holth(1) | | ✓ | | | | | | ✓ | | Alastair Maxwell(1) | | Chair | | ✓ | | | | | Kristin H. Holth(1) | | | ✓ | | | | ✓ | | Alastair Maxwell | | Alastair Maxwell | | | | Ann D. Pickard | | | | | | Chair | | ✓ | Ann D. Pickard | | | | | Chair | | ✓ | | H. Keith Jennings(1) | | H. Keith Jennings(1) | | | | Charles M. Sledge(1)(2) | | ✓ | | ✓ | | | | | | Number of Meetings in 2022 | | 5 | | 5 | | 4 | | 1 | Charles M. Sledge(1)(2) | | | Number of Meetings in 2023 | | Number of Meetings in 2023 | | | 12 | | 4 | | 4 | | 4 |

| (1) | Audit committee financial expert | |

| (2) | Independent board chair | |

| (3) | The Safety and Sustainability Committee was formed in connection with the Business Combination, and the Nominating, Governance and Sustainability Committee was renamed the Nominating and Governance Committee.

| |

Prior to the closing of the Business Combination, our committee composition was as follows:

| | | | | | | | | Director Name | | Audit | | Compensation | | Nominating, Governance

and Sustainability (3) | | Finance (4) | Robert W. Eifler | | | | | | | | | Paul Aronzon | | ✓ | | | | | | ✓ | Patrick J. Bartels, Jr. (1) | | Chair | | | | | | ✓ | Alan J. Hirshberg | | | | ✓ | | ✓ | | | Ann D. Pickard | | | | | | Chair | | | Charles M. Sledge (2) | | ✓ | | ✓ | | | | ✓ | Melanie M. Trent | | | | Chair | | ✓ | | |

| (1) | Audit committee financial expert

| |

| (2) | Independent board chair

| |

| (3) | The Safety and Sustainability Committee was formed in connection with the closing of the Business Combination, and the Nominating, Governance and Sustainability Committee was renamed the Nominating and Governance Committee.

| |

| (4) | The Finance Committee was dissolved prior to the closing of the Business Combination. The Finance Committee met eight times during 2022.

| |

| | | Noble Corporation plc2023 Proxy Statement

| | 15

|

Audit Committee The primary purposes of the Company’s audit committeeAudit Committee are to: Assist the Board with oversight of: the integrity of our financial statements and our financial reporting process and systems of internal controls regarding finance and accounting; our compliance with the Company’s standards of business ethics and legal and regulatory requirements; the qualifications and independence of our independent auditors; and the performance of our independent auditors and internal auditors; and Prepare reports of the audit committeeAudit Committee that are required by the rules of the SEC to be included in the proxy statement for our annual general meeting of shareholders. The primary responsibilities of the audit committeeAudit Committee include, among others, to: appoint, compensate, retain and oversee the Company’s auditors (including review and approval of the terms of engagement and fees); review with the auditors the Company’s financial reports (and other financial information) provided to the SEC and the investing public; review the Company’s system of internal controls, significant accounting principles and policies, and critical accounting policies; review the activities, budget, staffing, and structure of the internal audit function; review the Company’s major financial risk exposures and steps taken to monitor and mitigate such risks; and review related party transactions and conflicts of interest. Our Board has determined that each of Mr. Maxwell,Jennings, Mr. Sledge and Ms. Holth, independent directors, is an “audit committee financial expert” as that term is defined under the applicable SEC rules and regulations. | | | | Noble Corporation plc 2024 Proxy Statement | | 17 |

Compensation Committee The primary purposes of the compensation committeeCompensation Committee are to discharge our Board’ responsibilities relating to compensation of our directors and executive officers, and to: prepare an annual disclosure under the caption “Compensation Committee Report” for inclusion in our proxy statement for the Company’s annual general meeting of shareholders; prepare, in conjunction with our compensation advisers, a director’s compensationremuneration policy, to be approved by shareholders at least every three years, in accordance with the UK Companies Act; monitor compliance with applicable legal and regulatory requirements relating to the Company’s compensation policy and practices, including required disclosures and shareholder approvals; and assist the board in reviewing and administering compensation, benefits, incentive and equity-based compensation plans. The primary responsibilities of the compensation committeeCompensation Committee include, among others, to: determine the CEO’s goals and objectives, review his or her performance, determine the CEO’s compensation; review and approve compensation for other executive officers; review and approve incentive and equity-based compensation plans, any employment and severance arrangements, and any employee benefit plans; determine stockshare ownership guidelines and clawback policy and monitor compliance; assist the Board in reviewing and preparing disclosures, statements or reports regarding the Company’s compensation policies and practices as are required under applicable legal and regulatory requirements; and review the results of any advisory votes of our shareholders relating to compensation and oversee engagement efforts with shareholders on the subject of executive compensation. The “Compensation Discussion and Analysis” relating to 20222023 begins on page 2426 of this proxy statement. | | | 16Nominating & Governance Committee

| | 2023 Proxy StatementNoble Corporation plc

|

Nominating and Governance Committee

The primary purposes of the nominating and governance committeeNominating & Governance Committee are to: assist the Board in reviewing board composition and performance, including identifying, evaluating and recommending candidates for the board; assist the Board in reviewing succession planning with regard to our CEO; review and recommend to the Board the Company’s corporate governance guidelines; assist the Board in discharging its responsibilities on matters relating to the Company’s corporate governance policies and practices; and monitor compliance with applicable legal and regulatory requirements and other commitments relating to governance policies and practices of the Company’s ESG activities, including, without limitation, any requirements relating to disclosure of information. The primary responsibilities of the nominating and governanceNominating & Governance committee include, among others, to: review the size and committee structure of the Board; identify, interview and recommend to the Board Directors candidates for board service; discuss succession planning for the Board and key leadership roles on the Board and its committees consider director candidates nominated by shareholders; review director nomination process and determine director qualifications; review with management required disclosures relating to the Company’s governance practices; conduct an annual review of the Company’s code of business conduct and ethics; oversee board, committee, CEO and management evaluations; and review the CEO’s management succession plans and related matters.matters; and oversee new director orientation and ongoing education for directors. | | | | 18 | | 2024 Proxy Statement Noble Corporation plc |

Director Selection Criteria and Nomination Process The Board and the nominating and governanceNominating & Governance committee believe that the Board should be comprised of directors with diverse yet complementary backgrounds who bring different perspectives and experiences to the boardroom, generating healthy discussion and debate and more effective decision-making. Directors should also, at a minimum, have business or other relevant expertise that may be useful to the company.Company. The Board and the nominating and governance committeeNominating & Governance Committee also believe that directors should possess the highest personal and professional ethics and should be willing and able to devote the requisite amount of time to companyCompany business. When considering nominees for director, the nominating and governance committeeNominating & Governance Committee will take into account a number of factors, including, but not limited to, the following: the size of the existing Board; character, judgment, skill, education, relevant business experience, integrity, reputation, and other personal attributes or special talents that may be necessary for effective oversight given the global nature of the company’sCompany’s operations and strategy; independence from management, extent of existing commitments to other businesses, and potential conflicts of interest with other pursuits; characteristics that contribute to diversity, including gender, age, race, ethnicity, culture, disability, sexual orientation and geographic representation, as well as any other characteristics that may be identified from time to time; | | representation, as well as any other characteristics that may be identified from time to time;

|

financial and accounting background, to enable the committee to determine whether the nominee would be considered an “audit committee financial expert” or “financially literate” under the applicable rules of the NYSE and the SEC; and whether the potential nominee is subject to a disqualifying factor as described in the company’sCompany’s corporate governance guidelines or as included in any legal or regulatory requirements governing the company.Company. Board Composition and the Business Combination. Our current board composition was determined in connection with the closing of the Business Combination. Under the terms of Following the Business Combination, Agreement, the Board was comprised of three directors from each of the legacy Noble and Maersk Drilling companies. It is the belief of our Board that this board structure remains appropriate and is in the best interest of our shareholders because it aids in the successful integration of the two companies. Further, as noted above, a significant shareholder of legacy Maersk Drilling has the contractual right to designate up to two nominees to our Board. See “—Director Designation Rights,” on page 1112 above, for further information on this matter. Thus, our currentMr. Jennings was appointed to the Board is comprisedand to the Audit Committee in November of four legacy2023 and was recommended by an independent director in consultation with a director search & advisory firm. Retirement Under the Corporate Governance Guidelines of Noble, directors, including our CEO, and three legacy Maersk Drilling directors, including the designee of AMPH Invest.a director may not stand for re-election after his or her 72nd birthday, without wavier or exception. | | | Noble Corporation plc2023 Proxy Statement

| | 17

|

Commitment to Diversity. In addition to a focus on maintaining a board composition of directors with diverse, yet complementary, backgrounds who bring different perspectives and experiences to the boardroom, our Board considers gender and ethnicity as key aspects of a diverse board and includes these characteristics in its definition of diversity. It is therefore the beliefThe Board plans to assess its effectiveness in this regard as part of the Board that as integration proceedsits annual board and the business justification for board continuity diminishes, a greater focus on further diversifying our Board will become even more integral to our director selectionevaluation process. Toward this end, our Board has undertaken that should our nominating and governance committee engage independent advisors to assist in identifying candidates, the committee will require the advisors to present a diverse slate of candidates for consideration, which will, at a minimum, include female and racial or ethnic minority candidates.

Identifying Nominees. The nominating and governance committee’sNominating & Governance Committee’s process for identifying candidates includes seeking recommendations from one or more of the following: current and retired directors and executive officers of the Company; a firm (or firms) that specializes in identifying director candidates (which firm may earn a fee for its services paid by the Company); persons known to directors of the Company in accounting, legal and other professional service organizations or educational institutions; and | | • | | subject to compliance with applicable procedures, shareholders of the Company. See“— “—Shareholder Proposals and Nominations for our 2024 Annual General Meeting” on page 6470 for further information on the shareholder nomination process. |

The nominating and governanceNominating & Governance committee’s process for evaluating candidates includes: investigation of the person’s specific experiences and skills, time availability in light of commitments, potential conflicts of interest, and | | | | Noble Corporation plc 2024 Proxy Statement | | 19 |

independence from management and the Company. | | • | | Candidates recommended by a shareholder are evaluated in the same manner as are other candidates. Other than the designees under the Relationship Agreement (see “—“— Director Designation Rights”Rights” on page 11)12), we did not receive any recommendations from shareholders of the Company for director nominees for the Meeting. |

Safety and& Sustainability Committee The primary purposes of the safety and sustainability committeeSafety & Sustainability Committee are to: inform and assist the Board in its oversight role and make recommendations with respect to the Company’s identification, management, monitoring, and mitigation of risk in the areas of health, safety, the environment, and security; inform and assist the Board in its oversight role and make recommendations with respect to the Company’s policies and practices related to sustainability and corporate social responsibility; assist the Board in reviewing the Company’s policies and management systems with respect to sustainability and health, safety, environment and security (“HSES”) matters; and monitor compliance with applicable legal and regulatory requirements and other commitments relating to the environmental and social policies and practices of the Company’s ESG activities, including, without limitation, any requirements relating to disclosure of information. The primary responsibilities of the safety and sustainabilitySafety & Sustainability committee include, among others, to: oversee the Company’s strategy on HSES and Sustainability; oversee the Company’s compliance with HSES and sustainability laws and regulations, material HSES and sustainability litigation and regulatory proceedings; significant developments regarding HSES and sustainability; | | and sustainability litigation and regulatory proceedings; significant developments regarding HSES and sustainability;

|

review guidelines and policies on risk assessment and management of HSES and sustainability risks; oversee the Company’s governance process over climate-relatedclimate- related risks; and review and recommend to the Board principles, policies and practices of sustainability, including making recommendations to the board regarding the content and format of the Company’s annual sustainability report and other applicable sustainability disclosure. Board Oversight of Sustainability Matters. It is the belief of our Board, that managing sustainability issues has become core to long-term business strategy and to managing enterprise risk. For example, responding to climate risk, including committing to establishing clear GHG targets and goals, has become key to the business strategy of many businesses, including ours. Thus, board oversight of this important driver of business success has become central to the Board’s mission.mission and the Board is updated quarterly on sustainability matters. In recognition of this imperative, our Board has delegated oversight of these matters to our safety and sustainability committeeSafety & Sustainability Committee so that the Board can undertake more focused oversight of management’s activities in these areas. Our SVP, Operational Excellence and Sustainability, our SVP, Operations and our Head of Health, Safety and Environmental report regularly to the Safety & Sustainability Committee and are regularly in attendance at committee meetings. | | | 18Attendance Policy

| | 2023 Proxy StatementNoble Corporation plc

|

Attendance Policy

Attendance at Board Meetings In 2022,2023, our Board held nineeleven meetings. In 2022,2023, each incumbent director attended, in person or telephonically, at least 75% of the aggregate of (1) the total number of meetings of our Board and (2) the total number of meetings of committees of our Board on which such director served (during the periods that such director served). Annual General Meeting of Shareholders Under the Company’s policy on director attendance at annual general meetings of shareholders, all directors are expected to attend each annual general meeting in person or telephonically, and any director who is unable to attend the annual general meeting is responsible for notifying the Chairman of the Board in advance of the meeting. AtAll seven directors then in office attended the date of this proxy statement, we know of no director who will not attend the Meeting. The Company has not held an2023 annual general meeting of shareholders since 2020 due to its petition for bankruptcyshareholders. | | | | 20 | | 2024 Proxy Statement Noble Corporation plc |

in July 2020, from which it emerged in February 2021, and our extraordinary shareholder meeting in 2022 to approve the Business Combination. See – “Explanatory Note,” above on page V for further information on our bankruptcy filing and the Business Combination. In 2020, all directors attended the annual general meeting of shareholders held on May 21, 2020. In 2022, six of our directors serving at that time attended the extraordinary general meeting for approval of the Business Combination.

Board Leadership Structure and Board Evaluation Our Articles of Association and corporate governance guidelines provide our Board the flexibility either to combine or to separate the positions of Chair and CEO. At the current time, our Board believes that the Company and our shareholders are best served by separating the positions of Chair and CEO. The separation of duties will allow Mr. Sledge and Mr. Eifler to focus on their respective responsibilities as Chairman and CEO. Further, the Board believes our current structure, with an independent Chairman who is well-versed in the needs of a complex business and has strong, well-defined governance duties, gives our Board a strong leadership and corporate governance structure that best serves the needs of Noble and its shareholders. Our Board believes that Mr. Sledge is well suited to serve as Chairman given his significant managerial, financial and operational experience, as well as his experience in corporate governance. As a result of his broad-based and relevant background, as well as his deep knowledge of our business, Mr. Sledge is well-positioned as Chairman to provide constructive, independent and informed guidance and oversight to management. Our Board believes that the Company and our shareholders are best served when directors are free to exercise their respective independent judgment to determine what leadership structure works best for us based upon the then current facts and circumstances. Although our Board may determine to combine the positions of Chairman and CEO in the future should circumstances change, we believe that separating these positions is currently the right leadership structure for our company.Company. In addition to Mr. Eifler, our Board currently has sixseven additional members, all of whom are independent under the NYSE corporate governance rules as described under “—Board IndependenceIndependence..” Pursuant to our corporate governance guidelines, our non-management directors meet in executive sessions without our CEO or any other member of management present in connection with each regularly scheduled meeting of our Board. As independent Chair, Mr. Sledge presides at these regularly scheduled executive sessions of our Board. The Chair is also responsible for approving meeting agendas and meeting schedules for our Board, acting as an available conduit for the communication of information from the non-management directors to our CEO and coordinating with the CEO the development of the CEO’s annual goals and objectives. In addition, each of our standing committees (the audit committee,Audit Committee, the compensation committee,Compensation Committee, the nominating and governanceNominating & Governance committee, and the safety and sustainabilitySafety & Sustainability committee) is composed of independent directors and has a non-management, independent board member acting as chair. Board and Committee Evaluation To provide ongoing reviews of the effectiveness of our Board, including the effectiveness of our leadership structure, our corporate governance guidelines provide forand the charters of each of our committees both mandate annual assessments by board members of the effectiveness of our Board and each of our committees on which such members serve. Our assessments involve a structured assessment review that is led by the Chair, for the Board, and by each committee chairperson, for theeach applicable committee. The assessment ensures all necessary issues were considered to fulfill Board and committee responsibilities and measures effectiveness of Board oversight, ensures meeting objectives were satisfied, all agenda items sufficiently considered and information presented was complete, understandable and organized and identifies issues that need additional dialogue. Results of the annual assessment is reviewed by the Nominating & Governance Committee and summarized for the full Board. The results are then discussed atby the board levelBoard and, following the assessment, the Board determines the relevant actions to be taken to enhance our governance. Due Based on the Board’s 2023 annual evaluation process, the following actions have been implemented: Optimization of meeting materials and time allocation to the material changeenhance robust dialogue and discussions. Increased focus on Board succession plans including formal inclusion in the compositionCharter of our Board in October 2022, our Board and its committees did not complete an annual evaluation for 2022 as they had only convened for one meeting at that time. The Board and its committees will conduct an annual assessment in 2023.the Nominating & Governance Committee. Optimization of virtual meetings. The annual review of the diversity and the appropriate balance of experience, skills and attributes of the directors has resulted in recent director refreshment and committee membership changes. | | | Noble Corporation plc 20232024 Proxy Statement | | 1921

|

| | | | | Risk Management Oversight Consistent with our Articles of Association and our Corporate Governance Guidelines, and the Recommendations for Corporate Governance issued by the Danish Committee on Corporate Governance in December 2020 and implemented by Nasdaq Copenhagen, our Board is responsible for determining the ultimate direction of our business, determining the principles of our business strategy and policies and promoting the long-term interests and sustainability of the Company. Our Board possesses and exercises oversight authority over our business and, subject to our governing documents and applicable law, generally delegates day-to-day management of the Company to our CEO and our executive management. Viewed from this perspective and founded upon the strategy and business model of the Company, our Board generally oversees risk management and considers the most significant risks, including but not limited to safety, cybersecurity, climate & environmental strategic,risks, business, accounting, and liquidity risks; and the CEO and other members of executive management generally manage, monitor, and communicate the actual and potential risks material to the Company, collectively through the Enterprise Risk Management (“ERM”) program for the Company. The ERM program is designed to ensure that the most significant risks to the Company, on a consolidated basis, are being identified, managed and monitored appropriately, and that due care is exercised in considering such risks in the management of the Company. Role of the Board and Committees. Our full Board provides oversight of the ERM program and determines the Company’s risk tolerance for the operation and management of the Company, and ensures management has an effective and ongoing program in place for monitoring and assessing and, to the extent appropriate, mitigating such risks within directed tolerances. Our Board regularly receives reports and monitors our ERM program along with other risk management information provided by management and other resources, on a quarterly basis and provides feedback to management as part of the continuous improvement and alignment of risk management practices, strategies and systems, consistent with the risk philosophy and risk tolerances of the Company. Pursuant to the requirements of laws, rules and regulations that apply to companies whose securities are publicly traded in the United States, the Audit Committee of our Board assists the full Board in oversight of risks to the Company, including the integrity of the Company’s financial statements, our standards of business ethics, and our compliance with legal and regulatory requirements, and various other matters relating to our publicly available financial information and our internal and independent auditors. Our Audit Committee also discusses policies with respect to risk assessment and risk management with our management team. Oversight of certain risks associated with the performance of our executive management fall within the authority of our Nominating and Corporate Governance Committee, which is responsible for evaluating potential conflicts of interest and independence of Board directors and Board candidates, monitoring and developing corporate governance principles and overseeing the process through which our Board, our CEO and our executive management are evaluated. Oversight of risks associated with retaining executive management fall principally within the scope of the authority of our Compensation Committee, which assists our Board in reviewing and administering compensation, benefits, incentive and equity-based compensation plans. Finally, oversight of risks associated with health, safety, environment, security and sustainability matters, including climate and social issues, fall with the scope of authority delegated to our Safety and& Sustainability committee. Committee. Role of Management. We have not concentrated responsibility for all risk management in a single risk management officer but rather we have implemented an ERM steering committee comprised of executive management and certain other members of management to administer the program. The ERM steering committee: monitors the universe of risks that we face; identifies risks that may develop or evolve with the potential to become material to the Company; establishes processes for identifying, managing, avoiding,designed to identify, manage, avoid, and monitoringmonitor risks pursuant to the Company’s risk tolerance as established by the Board; establishes and implements mitigation and monitoring strategies with the necessary resources; regularly communicates to and works with the Board and each committee of the Board, including its members or their designees, the risks to the Company including risks that may be of concern to the Board or a committee of the Board; and updates the Board on the effectiveness and details of the ERM program. | | | 2022

| | 20232024 Proxy Statement Noble Corporation plc

|

| | | | | | | Shareholder Communications with Directors Our Board has approved the following process for shareholders of the Company and other interested parties to send communications to our directors. To contact all directors on our Board, all directors on a committee, an individual director or the non-management directors a group, the shareholder or interested party can use the following means of communication: | | • | | mail: Noble Corporation plc |

Attention: Corporate Secretary, 13135 Dairy Ashford, Suite 800, Sugar Land, TX 77478; | | • | | e-mail: NobleBoard@noblecorp.com; or |

| | • | | hotline: the NobleLine (anonymous and available 24 hours a day, seven days a week) at 1-877-285-4162 or +1-704-544-2879+1-704-544-2879 or http://www.nobleline.ethicspoint.com. |

All communications received in the mail are opened by the office of the Company’s Secretary for the purpose of determining whether the contents represent a message to our Board. All communications received electronically are processed under the oversight of our Board by the Company’s general counsel or chief compliance officer. Complaints or concerns relating to the Company’s accounting, internal accounting controls or auditing matters are referred to the audit committee of our Board.Audit Committee. Complaints or concerns relating to other corporate matters, which are not addressed to a specific director, are referred to the appropriate functional manager within the Company for review and response. Complaints or concerns relating to corporate matters other than the specific items referred to the audit committeeAudit Committee as described above, which are addressed to a specific director, committee or group of directors, are promptly relayed to such persons. Director EducationOnboarding All new directors participate in a robust director orientation and onboarding process to ensure a working knowledge of our business, strategies, capital structure, governance model, operating performance and culture and a successful integration into boardroom discussions as soon as possible. Our director manual contains important information about the Company and the responsibilities of our directors, including: our Articles of Association; guidelines for assignments regarding standing committees of our Board; the charters for each of our committees; a summary of laws and regulations regarding compliance with insider reporting and trading; share ownership guidelines, a statement of the Company paradigms and code of business conduct and ethics that govern how we conduct our business; and our safety policy and quality policy and objectives. All new directors also have the opportunity to tour our training facility and NORMS headquarters in Sugar land Texas, Noble Advances, and meet with fellow directors and management. Director Education Throughout the year, management also presents on topics that are timely and impactful to the Company and specific deep-dive sessions and workshops may be held to further increase directors’ understanding of issues affecting the Company. On occasion, individual directors or the full Board may visit Noble facilities in connection with Board meetings or deep-dive sessions with management. The commitment of our directors also extends well beyond preparation for, and participation at, regularly scheduled Board meetings. Engagement beyond the boardroom provides our directors with additional insights into our businesses and industry. We provide our directors with information, materials and materialsoutside speakers that are designed to assist them in performing their duties as directors. We provide directors with periodic training on certain policies, standards and procedures of the Company, including guidance and advice on compliance therewith. We provide director manuals, periodic presentations on new developments in relevant areas, such as legal and accounting matters, as well as opportunities to attend director education programs at the Company’s expense. Our director manual contains important information aboutexpense, and memberships with the Company and the responsibilities of our directors, including: our Articles of Association; guidelines for assignments regarding standing committees of our Board; the charters for each of our committees; a summary of laws and regulations regarding compliance with insider reporting and trading; corporate directors’ guidebooks published by such organizations as the American Bar Association Section of Business Law, National Association of Corporate DirectorsDirectors. During 2023 director education included presentations by Rystad Energy and American Society of Corporate Secretaries; a statement of the Company paradigms and code of business conduct and ethics that govern how we conduct our business; and our safety policy and quality policy and objectives.other guest speakers, including cybersecurity experts.

| | | | Noble Corporation plc 2024 Proxy Statement | | 23 |

Policies and Procedures Relating to Transactions with Related Persons Transactions with related persons are reviewed, approved, or ratified in accordance with policies and procedures set out in the UK Companies Act, 2006, our Articles of Association, the charter of our audit committeeAudit Committee, our Related Party Transaction Policy and our Code of Business Conduct and Ethics. These policies and procedures regarding related party transactions are in writing. Approval of related party transactions with our directorswriting and are governed by the UK Companies Act and our Articles of Association. The UK Companies Act provides that the directors may not have conflicts of interest, including related party transactions, with our Company unless the Articles of Association provide that such conflicts may exist and the conflicts are approvedimplemented by our directors. Our Articles of Association provide that a director may have conflicts of interest with the Company provided that the director fully discloses the nature of the conflict and the conflict is then approved by the disinterested directors. Finally, certain related party transactions between the

Company and a director as defined in the UK Companies Act will require shareholder approval.

Related party transactions are further governed by our code of business conduct and ethics and the charter of our audit committee. Our code of business conduct and ethics provides that business decisions must be made free from any conflicts of interest. Under the code, any employee, officer or director who becomes aware of a conflict, potential conflict or an uncertainty as to whether a conflict exists must bring the matter to the attention of their supervisor or other appropriate personnel. Any waiver of the code of business conduct and ethics may only be made by our Board or an authorized committee of our Board. A conflict of interest exists when an individual has or appears to have competing interests or duties of loyalty that place their personal self-interests against the interests of the Company, which includes related party transactions with the Company. The charter of our audit committee tasks the committee reviewing

| | | Noble Corporation plc2023 Proxy Statement

| | 21

|

conflict of interest situations on an ongoing basis and, if appropriate, approving related party transactions.Audit Committee.

Each year, we require all our directors, nominees for director, and executive officers to complete and sign a questionnaire in connection with our annual report and, if applicable, our annual general meeting of shareholders.questionnaire. The purpose of the questionnaire is to obtain information including information regardingwhich can be compared to our corporate records such as accounts payable & receivable in order to identify any transactions with related persons, for inclusion in our proxy statement or annual report. For this purpose, we consider “related persons” and “related “related person transactions” to be as defined in Item 404(a) of Regulation S-K. In addition, we review SEC filings made by beneficial owners of more than five percent of any class of our voting securities to determine whether information relating to transactions with such persons needs to be included in our proxy statement or annual report. There were no related-party transactions in 20222023 that were required to be reported pursuant to the applicable disclosure rules of the SEC, except as described herein.

Security Ownership of Certain Beneficial Owners and Management As of March 13, 2023,19, 2024, we had 134,820,742142,813,860 shares outstanding, excluding shares held in treasury. The following table sets forth, as of March 13, 2023,19, 2024, (1) the beneficial ownership of shares by each of our directors, each nominee for director, each “named executive officer” listed in the Summary Compensation Table appearing in this proxy statement and all current directors and executive officers as a group, and (2) information about the only persons who were known to the Company to be the beneficial owners of more than five percent of the Company’s outstanding shares. | | | Shares Beneficially Owned (1) | Shares Beneficially Owned (1) | | Shares Beneficially Owned (1) | | | Name | | Number of Shares | | Percent of

Class (2) | | | Number of Shares | | | Percent of

Class (2) | | | Name of Beneficial Owner | Name of Beneficial Owner | | Name of Beneficial Owner | | Name of Beneficial Owner | | Name of Beneficial Owner | | Name of Beneficial Owner | | Name of Beneficial Owner | | Name of Beneficial Owner | | Name of Beneficial Owner | | Name of Beneficial Owner | | | | AMPH Invest A/S | | | 27,890,529 | (3) | | | 20.7% | | AMPH Invest A/S | | AMPH Invest A/S | | AMPH Invest A/S | | | | 27,890,529 | (3) | | | 19.5 | % | | The Vanguard Group | | | 7,826,179 | (4) | | | 5.8% | | The Vanguard Group | | The Vanguard Group | | The Vanguard Group | | | | 11,244,214 | (4) | | | 7.9 | % | | Directors and Director Nominees | Directors and Director Nominees | | Directors and Director Nominees | | Directors and Director Nominees | | Directors and Director Nominees | | Directors and Director Nominees | | Directors and Director Nominees | | Directors and Director Nominees | | Directors and Director Nominees | | Directors and Director Nominees | | | | Robert W. Eifler | | | 219,093 | | | | — | | Robert W. Eifler | | Robert W. Eifler | | Robert W. Eifler | | | | 1,071,054 | | | | — | | | Claus V. Hemmingsen | | | 8,752 | | | | — | | Claus V. Hemmingsen | | Claus V. Hemmingsen | | Claus V. Hemmingsen | | | | 13,072 | | | | — | | | Alan J. Hirshberg | | | 18,432 | | | | — | | Alan J. Hirshberg | | Alan J. Hirshberg | | Alan J. Hirshberg | | | | 21,414 | | | | — | | | Kristin H. Holth | | | 1,452 | | | | — | | Kristin H. Holth | | Kristin H. Holth | | Kristin H. Holth | | | | 5,772 | | | | — | | | H. Keith Jennings | | H. Keith Jennings | | H. Keith Jennings | | H. Keith Jennings | | | | — | | | | — | | | Alastair Maxwell | | | 2,157 | | | | — | | Alastair Maxwell | | Alastair Maxwell | | Alastair Maxwell | | | | 6,477 | | | | — | | | Ann D. Pickard | | | 18,432 | | | | — | | Ann D. Pickard | | Ann D. Pickard | | Ann D. Pickard | | | | 21,414 | | | | — | | | Charles M. Sledge | | | 21,819 | | | | — | | Charles M. Sledge | | Charles M. Sledge | | Charles M. Sledge | | | | 25,770 | | | | — | | | Named Executive Officers (excluding any Director listed above) | Named Executive Officers (excluding any Director listed above) | | Named Executive Officers (excluding any Director listed above) | | Named Executive Officers (excluding any Director listed above) | | Named Executive Officers (excluding any Director listed above) | | Named Executive Officers (excluding any Director listed above) | | Named Executive Officers (excluding any Director listed above) | | Named Executive Officers (excluding any Director listed above) | | Named Executive Officers (excluding any Director listed above) | | Named Executive Officers (excluding any Director listed above) | | | | Richard B. Barker | | | 60,529 | | | | — | | Richard B. Barker | | Richard B. Barker | | Richard B. Barker | | | | 239,342 | | | | — | | | Blake A. Denton | | | 15,719 | | | | — | | Blake A. Denton | | Blake A. Denton | | Blake A. Denton | | | | 113,208 | | | | — | | | Joey M. Kawaja | | | 15,723 | | | | — | | William E. Turcotte | | | 25,387 | | | | — | | All current directors and executive officers as a group (13 persons) | | | 408,472 | | | | —% | | Joey M. Kawaja | | Joey M. Kawaja | | Joey M. Kawaja | | | | 113,208 | | | | — | | | | | | | Caroline Alting | | Caroline Alting | | Caroline Alting | | Caroline Alting | | | | — | | | | — | | | All current directors and executive officers as a group (15 persons) | | All current directors and executive officers as a group (15 persons) | | All current directors and executive officers as a group (15 persons) | | All current directors and executive officers as a group (15 persons) | | | | 1,636,481 | (5) | | | 1.1 | % |

| (1) | Unless otherwise indicated, the beneficial owner has sole voting and investment power over all shares listed. Unless otherwise indicated, the address of each beneficial owner is 3rd Floor, 1 Ashley road, Altrincham, Cheshire, United Kingdom WA14 2DT. |

| | | | 24 | | 2024 Proxy Statement Noble Corporation plc |

| (2) | The percent of class shown is less than one percent unless otherwise indicated. |

| (3) | Based solely on Schedule 13D13D/A filed with the SEC on October 13, 2022September 1, 2023 by AMPH Invest A/S. Such filing indicates that AMPH Invest A/S, hasA.P. Møller Holding A/S and A.P. Møller og Hustru Chastine Mc-Kinney Møllers Fond til almene Formaal have shared voting power and shared dispositive power with respect to 27,890,529 shares. The address for AMPH Invest A/S is Esplanaden 50, 1263 Copenhagen K, Denmark. |